Hello! I’m Cindy Couyoumjian and I want to invite you to read my book, Redefining Financial Literacy. One of the disturbing ironies of American economic power is that we have one of the poorest financial literacy rates in the industrialized world. Consider the following statistics:

- 40% of adults rate their own knowledge of personal finance as extremely low and state that they need guidance.

- 60% of adults have no budget.

- Less than 50% of Americans live within their means or have saved for an emergency.

- More than 30% of Americans pay only the minimum on their credit card each month.

- The average American family’s credit card debt is $15,000, and they owe $33,000 in student loans.

- 85% of Americans are worried they are not ready for retirement.

What we are witnessing today appears to be nothing short of a social crisis, unprecedented in scope and far-reaching in its implications. Financial illiteracy does not, of course, occur in a vacuum. The financial planning industry spends around $17 billion a year to market products and services to consumers, but it spends only $670 million on educating those consumers. Although many financial advisors recognize the problem of financial literacy, “only 4 in 10 advisors are doing anything to address the problem, meaning the majority are ignoring the issue.” With a reasonable level of financial literacy, you can advocate for your own financial future.

Hidden Forces

One of the reasons I wrote my book is to first address the financial literacy crisis and to also expand our definition of what it means to be financially literate in our complex, globally interconnected world. For financial literacy to be effective, it must include an awareness and understanding of the hidden forces that intersect and overlap in such a way as to influence your hard-earned money. My book explores these historical, political, economic, psychological, and even social media forces and how they can impact your investment and retirement strategy.

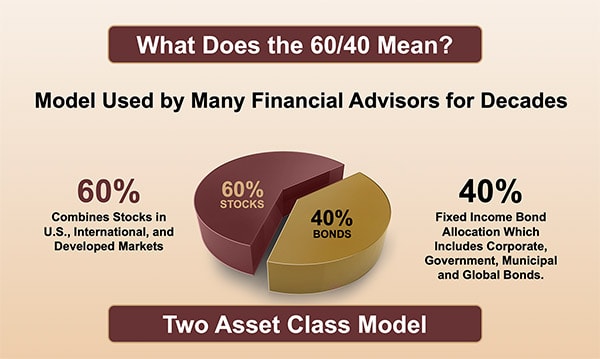

Why the 60/40 Strategy is Potentially Broken

One example of how poor financial literacy can hurt your investment strategy is the popular 60/40 portfolio. This strategy allows you to invest 60% of your money in stocks and 40% in bonds. What made this portfolio popular was the inverse correlation between stocks and bonds. In other words, if stocks moved down, bonds would move up to protect you and vice versa. Bond yields today are at an all-time low, and have been for several years now, thus negating the inverse relationship that made the 60/40 portfolio attractive in the first place.

A REALM of Possibilities

Now, why would you expose yourself to the uncertainty of the stock market without adequate protection? There are actionable steps you can take to protect your assets. For example, my flexible and customizable multi-asset class REALM model can potentially offer you consistently strong returns while managing risk. I urge you to buy my book to educate yourself about these hidden market forces while also improving your financial literacy.

About Cindy Couyoumjian

Cindy Couyoumjian’s greatest passion is bringing dynamic investment strategies to her clients to customize each portfolio aimed to address the transitions in one’s life, while staying abreast of the ever-changing economic landscape. She understands that no single approach is the right one for every investor. Her 34 years in the industry have provided her experience, knowledge, and numerous securities licenses: Series 63, 6, 65, 7, 22, 24, 26, and California Insurance License #0719038.

She is committed to enriching the lives of the retail investor through financial literacy by providing education, knowledge, and empowering investors to make good financial decisions. Cindy attributes her success to her unwavering dedication to her clients, her ethics, her enthusiasm, as well as impeccable customer service.

Cindy has devoted herself to pursuing higher education in order to equip herself to better support and guide her clients in a holistic approach to investing, as well as, developing the REALM® investment philosophy. Since 2012, Cindy has been part of an elite group of advisors ranked as one of the Top 10 producers within her Broker-Dealer, Independent Financial Group, LLC while overseeing approximately more than $200 million in assets.

Growing up in Warren, Michigan, she graduated from Oakland University in 1985, with a Marketing Degree. She launched her own firm in 2003 after 18 years with Equitable to provide her clients with top investment choices.

Contact Cindy Couyoumjian

Email: cindy@CinergyFinancial.com

Phone: (714) 210-0549

1. Douglas P. McCormick, “Financial Literacy—The Big Problem No One Is Talking About,” Huffpost.com, June 3, 2017. https://www.huffpost.com/entry/financial-literacythe-big_b_10264622.

2. Greg Iacurci, “Financial Literacy: An Epic Fail in America,” Investmentnews.com, March 2, 2019. https://www.investmentnews.com/financial-literacy-an-epic-fail-in-america-78385.

3. Ibid.