Financial Literacy

Why Information is Leading Investors to Financial Illiteracy…

- We Live in a “Google-ized” World! Information is our Force2

- Thinking is Hard Work! Society Replaces the Pain of Thinking with Instant Information2

- We Skim Information! Doesn’t Provide The Knowledge to Make Educated and Informed Decisions About Our Finances2

- What You Don’t Know Cannot Hurt You Ultimately, What You Don’t Know May Leave You Behind2

The Financial Service Industry May be Adding to The Financial Literacy Crisis

- In 2018, Investment News Stated 58.7% of Financial Planners Fail to Take Action to Improve “Financial Literacy” in Their Community8

- National Financial Education Council States: Lack of Knowledge Cost Americans $295 Billion in 201810

- Alan Greenspan, Federal Reserve Chairman, Declared the #1 Problem in Today’s Generation and Economy is the Lack of Financial Literacy11

The U.S. Education System Has Failed to Address the Topic of Financial Literacy

- According to a Global Financial Literacy Survey of 143 Nations, The United States Ranked 14th in Financial Literacy6

- Champlain College’s Center of Financial Literacy Stated that Five (5) States: Alabama, Missouri, Tennessee, Utah and Virginia Require ½ Year of Personal Finance Course7

Most States Don’t Require Financial Literacy Classes 7

Information Overload, Confusing and Misleading Investors

Lack of Trust

May be Contributing to Financial Literacy Crisis

The United States is Enduring Unprecedented Crisis of Trust

According to the 2018 Edelman Trust Barometer, a Survey Conducted in 28 Countries Over an 18 Year Period3

- 7 OUT OF 10 PEOPLE Feel that Fake News is Used as an Information Weapon

- LACK OF TRUST IN U.S. Is Due to the Government and U.S. Financial Firms, and Linked to Economic and Social Issues

- DROP IN TRUST BAROMETER Caused By Lack of Objectivity (Silence is Taxing Trust) and Information Overload, Confusing and Misleading Investors.

- TRUST IN BUSINESS Most Trust Industry is Technology, Least Trusted is Financial Services

It’s About Transforming Your Mindset.

We’ll tell you

- How we got here – this is why you’re not financially literate.

- Why the 60/40 model is broken

- What to do about it

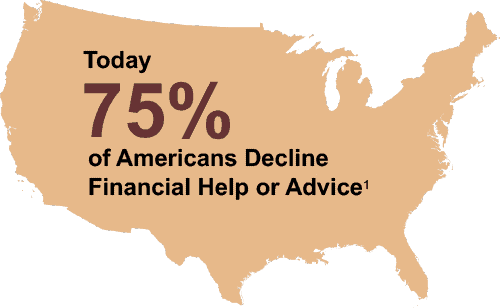

The Dunning-Kruger Effect May be Why Two-Thirds of Americans Reject Financial Guidance4

Cognitive Bias:

People Mistakenly Asses Ability Greater than it is.4

Causes:

People Overestimate Their Own Skills and Fail to Recognize the Expertise of Experts4

Solutions:

Learn More About a Subject Matter and Begin to Recognize You may have a Lack of Knowledge4

Learn More About a Subject Matter and Begin to Recognize You may have a Lack of Knowledge4

Gain Information: “Financial Literacy” To Become More Informed and Increase Confidence to Make Better Decisions

Example: From 2000 – 2018: Average Return for Investor without an Advisor with Stock/Bond Model was 1.9%5

The Importance of Financial Literacy

Provides:

Knowledge Aimed to Promote Skills to Manage Spending, Saving, and Debt.

Information:

Intended to Build Confidence to Potentially Help Investors Reach Their Financial Goals.

Benefits:

Understanding the Financial Planning Process to Potentially Improve Individual Investor Goals.

Awareness:

Promotes Understanding About Inflation, Tax Considerations, Liquidity, and Realistic Expected Returns.

So, That’s Why We Focus on Financial Literacy.

Call us Today to Schedule a Consultation:

(714) 210-0549

Notes

1. https://www.cnbc.com/2019/04/01/when-it-comes-to-their-financial-future-most-americans-are-winging-it.html

2. Dr. R.F. Gregory, “Notes From The Café”, Pantheon Book, 2014

3. 2018 Edelman Trust Barometer, https://www.edelman.com/trust-barometer

4. https://www.verywellmind.com/an-overview-of-the-dunning-kruger-effect-4160740

5. Morningstar. Indexes used are as follows: EAFE: MSCI EAFE, Stocks: S&P 500 Index, Bonds: Bloomberg Barclays Aggregate Bond Index, Inflation: CPI, 60/40: A balanced portfolio with 60% invested in S&P 500 Index and 40% invested in Bloomberg Barclays Aggregate Bond Index, 40/60: A balanced portfolio with 40% invested in S&P 500 Index and 40% invested in Bloomberg Barclays Aggregate Bond Index. Returns are annualized (and total return where applicable) and represent the period starting 1/1/2000 and ending 12/31/2018. Each of these asset classes has its own set of investment characteristics and risks and investors should consider these risks carefully prior to making any investments. Investors cannot invest directly in an index.

6. Ann Carrns/The New York Times, Jan 18, 2018; https://www.nytimes.com/2018/01/19/your-money/states-financial-literacy-classes.html

7. DAN KADLEC/Money Magazine November 18, 2015; http://money.com/money/4115378/united-states-financial-literacy/

8. “Financial Literacy: An Epic Fail in America.” Greg Iacurci. Investment News. 2019. https://www.investmentnews.com/article/20190302/FEATURE/190229936/financial-literacy-an-epic-fail-in-america

9. According to Consumer Finance Protection Bureau in 2013, Financial Service Companies Spent $17 Billion on Market Product and Service and only $670 million on Financial Education (Less than 3% of their budget)

10. “What is Financial Literacy and Why Does It Matter to Me?” Brian O’Connell. TheStreet. 2019. https://www.thestreet.com/personal-finance/education/what-is-financial-literacy-14874372

11. “Financial Literacy- The Big Problem No One is Talking About.” Douglas P. McCormick. Huffpost. 2017. https://www.huffpost.com/entry/financial-literacythe big_b_10264622?guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAIEj5AiS2yahIR44cFDEX4N_twkapXZAQMtu4j1X3LeDbC5XF01tK89iUT4xd2e_KAiTY3LZzp33I-3TueT7M2Yfw7XxPYLc-dP4GlpCFFnRtnhs_JXdQrPZeTE_i_JvD-NGexwkGjbyIg-nVE4Gy5iEzDQkfK6_QIycf8N_iK2R&guccounter=2