Targeted Retirement Advice

Retirement is one of those life events that many of us procrastinate about. It looms over us on some distant horizon, ignored and put out of mind. And yet the statistics show that an overwhelming number of Americans are ill prepared for retirement. Are you? Once you begin asking the right questions, you need to sit down with a qualified and experienced financial advisor to create a plan that is customizable to your specific needs. If you risk going it alone, you risk not utilizing professional guidance. Click below to watch an introduction to what we’re talking about.

Lets’ begin with some basic questions you need to ask yourself before you retire.

- When should I retire?

- How much will I need for my retirement years?

- How much can I safely withdraw each year without depleting my investment portfolio?

- How do I provide a legacy for my loved ones?

- Will I be able to rely on Social Security benefits?

- If my pension will take care of me, so why do I need to prepare?

- Should I plan for retirement on my own or get targeted retirement advice from a qualified and experienced financial planner?

The key is financial literacy. Financial literacy, coupled with planning and asking the right questions, will go far in planning a healthy retirement. If you don’t have answers to these questions already, it’s time to get started.

5 Factors Contributing to Retirement Uncertainty

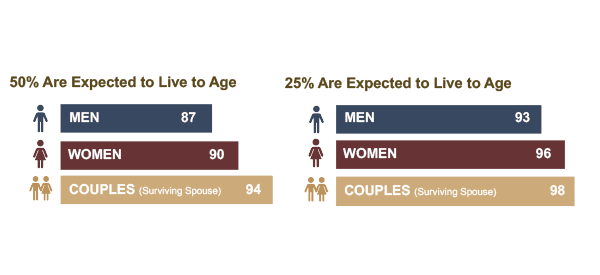

Longer Life Spans

Expected Life Span of Individuals and Couples Age 651

Running Out of Money

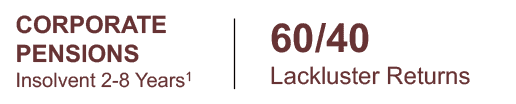

Lack of Returns From the 60% Stock and 40% Bond Model During 2000-2018.

46% of Investors Feel They Will Outlive Their Savings2

Volatile Stock Markets

The Average Retiree Will Likely Face 5 Down Markets in Retirement3

SINCE 1945:

- 27 Market Corrections Greater Than 10%4

- 12 Market Corrections with Losses That Exceeded 20%4

Rising Cost: Inflation

It is Estimated That An Average, Healthy, 65-year-old Couple Will Need $260,000

To Pay For Medical Expenses For the Remainder of Their Lives.5

Retirement Sponsored Programs

POOR PERFORMANCE

The Government, Who Protects Bankrupt Pension Plans, Pension Benefit Guarantee Corporation (PBGC) is Projected to go Insolvent in 5 Years8

Notes

1. Society of Actuaries RP-2014 Mortality Table projected with Mortality Improvement Scale MP-2014, 2016

2. Nanci Hellmich, USA TODAY “Big retirement fear: Outliving your savings” https://www.usatoday.com/story/money/personalfinance/2014/09/24/investors-fear-outliving-retirement-savings/16095591/

3. 1. SeekingAlpha.com What should Retirees Do During A Bear Market?, 6/23/17; TheBalance.com, Average Retirement Age in the United States, 3/16/17

4. Time.com/Money, Here’s How Devastating a Bear Market Can Be, January 26, 2016.

5. Society of Actuaries RP-2014 Mortality Table projected with Mortality Improvement Scale MP-2014, 2016

6. U.S. Department of Labor/Bureau of Labor Statistics, based on Medical index from 12/1982 through 12/2014

7. 12/19/2017 USChamber.com – “The Multiemployer Pension Plan Crisis: The History, Legislation, and What’s Next?” https://www.uschamber.com/report/the-multiemployer-pension-plan-crisis-the-history-legislation-and-whats-next

8. 03/19/2018 Sean Williams, “Could Social Security Run Out Of Money?”